Inflation refers to the broader increase in prices of items and services in the entire economy over time. To achieve its objectives of maximum employment and stable pricing, the Federal Reserve estimates that annual inflation should hover around 2%. Nonetheless, inflation diminishes the purchasing power of a currency.

In general, inflation and economic growth go hand in hand, and one factor that could lead to increased inflation is an overheated economy.

Stagflation refers to a stagnating economy plagued not merely by high inflation but also by slow growth. The causes of stagflation can be weak fiscal and monetary policies, austerity measures, or sudden increases in oil prices.

The differences between stagflation and inflation are minor but important. This article will discuss the detailed differences between stagflation and inflation.

What is Stagflation?

As the name suggests, stagflation is a combination of "stagnation" and "inflation" – and it means precisely that. Stagflation is a term that describes a stagnant economy, high inflation, and high unemployment. Historically, the investing environment has been negative during stagflation, as lower sales and high input prices result in lower revenue per share for companies.

What is Inflation?

Inflation is a term that describes the general increase in the prices of items, products and services in an economy over time. Low and consistent inflation has historically been linked to appealing interest rates, low unemployment, and various investment environments.

Types of Inflation

There are two primary types of inflation:

• Demand-pull inflation: This type of inflation happens when overall demand for products and services rises while supply stays the same, which causes prices to be "pulled up."

• Cost-push inflation: This type of inflation happens when production costs rise, and businesses that produce the goods and services in response raise their prices for customers, "pushing" prices upward.

Stagflation Vs. Inflation: Key Differences

Stagflation Basics

Stagflation describes the occurrence of inflation and stagnation at the same time.

Causes: Rising inflation or interest rates from the Federal Reserve are frequently accompanied by an aggressive monetary policy, which slows or "stagnates" the economy.

Impacts: Employee job loss risk is higher, and earnings are lower during stagflation periods, which might weaken consumer confidence. Higher input prices and reduced sales can harm businesses, leading to lower profit margins and stock prices, affecting investors.

How long does stagflation last: The duration of stagflation is generally estimated in months instead of years. From 1973 through 1982, for example, numerous economies experienced stagflation.

Causes of Stagflation

The following are two main causes of stagflation;

- Fiscal and monetary policies

- Supply shocks

For instance, a low supply of goods or commodities combined with a Federal policy of raising interest rates might result in both inflation and an economic downturn at the same time, which are traditional indicators of stagflation.

Inflation Basics

Inflation is more than just an increase in the pricing of products and services. It is important to understand the basics of inflation, its causes, impacts, and how long it can last. ·

Causes: Inflationary pressures arise when the demand for products and services surpasses the supply. Inflation will also occur when the capital supply increases faster than the gross dometic product (GDP). Supply chain challenges and increased customer demand as a result of the Covid-19 outbreak have been recent causes.

Impacts: The people who are most adversely affected by inflation include those who are on a fixed income and retired, investors who own long-term bonds, owners of variable-rate mortgages, and people who have credit line balances. Additionally, when inflation increases, equities markets sometimes get jittery, posing a risk to equity investors.

How Long it Lasts: In most global economies, some degree of inflation is always present. The US experienced more severe effects of The Great Inflation from 1965 to 1982.

Risks of Stagflation

The following are some of the risks or potential adverse effects of stagflation:

- The decline in the actual value of money: Stagflation diminishes the real value of money due to higher prices for goods and services.

- Rising interest rates: During stagflationary periods, the Federal Reserve normally uses higher rates to tackle inflation. Higher rates may significantly affect customers who have financial obligations, adding to economic pressure.

- Lower corporate earnings: When input costs rise and sales decline, corporate earnings fall, which can also be bad for stock prices.

- Higher unemployment: Companies may decrease labor costs by terminating employees to safeguard their bottom line.

Risks of Inflation

The following are some of the risks or potential adverse effects of inflation:

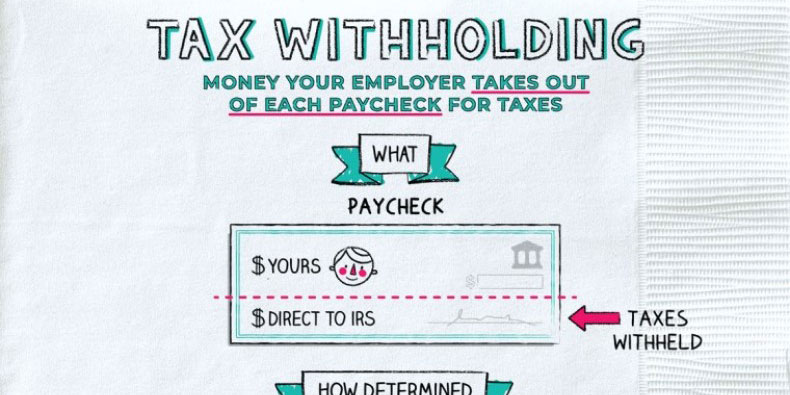

- The decline of purchasing power: Due to inflation, money loses actual value over time, making it more expensive to purchase the same good or service.

- Higher interest rates: The Federal Reserve frequently increases interest rates to control inflation, which typically leads to higher interest rates on mortgages and varying rates of debt like credit cards and lines of credit.

- Declining bond prices: Bond prices and interest rates typically show an inverse connection, which means that when rates rise, bond prices decline.

Bottom Line

Stagflation is the result of high inflation and simultaneously poor economic growth. Inflation is the general upward trend in prices of goods and services over time. Stagflation is largely regarded as an alarming problem that is challenging to resolve, whereas inflation is generally viewed as healthy and normal, at least at steady and low levels.