Introduction

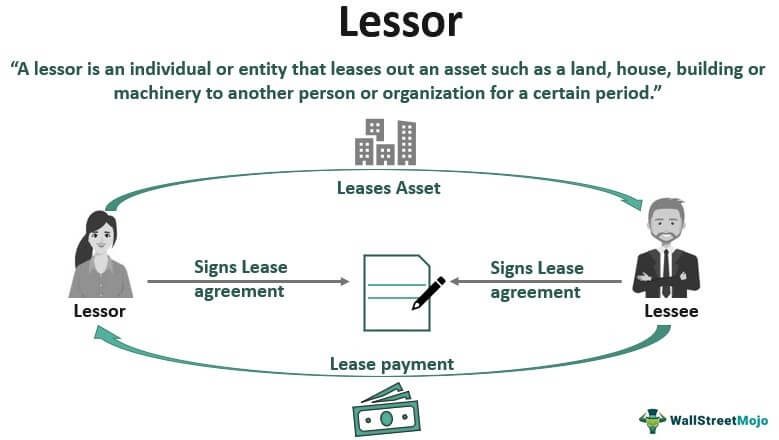

Every person working in the financial sector needs to know who the Lessor and lessee are in a leasing agreement. A lease is an agreement between two parties whereby one party (the Lessor) agrees to let the other party (the lessee) use an asset in exchange for regular payments over a specific period. The lessee is responsible for making payments to the Lessor for the use of the purchase or property. Leasing an asset typically involves a lesser initial investment than buying the thing outright. In a lease agreement, both the Lessor and the lessee make legal commitments to one another.

How The Lease Agreement Works

Leasing out one's possessions to those in need might be a reliable source of income for its owner. There are guarantees in the leasing agreement that have been evaluated and agreed upon by both parties. It lays out the responsibilities of the Lessor as well as the rights of the lessee. It spells out what will happen if one of the parties to the agreement stops fulfilling their obligations. That can mean paying fines and fees, losing your home, or repossessing your car. Most leases have a set expiration date, which is suitable for everyone involved. Lessee has the option to either find a new lease arrangement or renew at the end of the term; Lessor has the opportunity to either continue with the lessee or take back the asset for their use or sell it.

Lessor And Lessee Agreement

A lease is a contract between the Lessor and the lessee to use the leased property. Important things related to the use of an asset, such as the terms and conditions established by a court of law, are spelled out in the agreement. Both parties must follow the agreed-upon terms. Lessor, as the legal owner of the asset, has the authority to terminate the lease or evict the lessee if the lessee commits any act that is contrary to the terms of the lease agreement. If both parties are qualified, a lease agreement can be entered into for almost any form of property (equipment, vehicles, etc.).

Types Of Lease Agreements

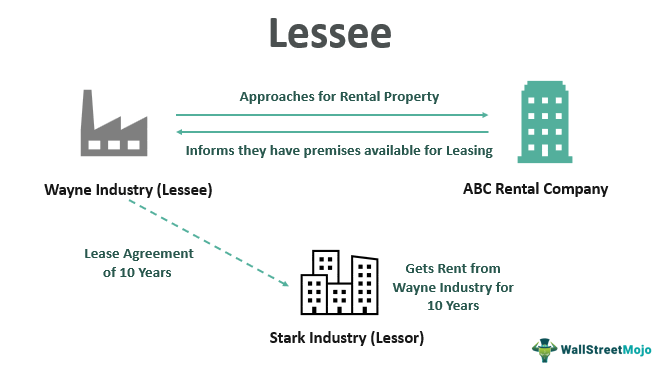

Leases come in many forms; residential leases are just one. Typically, a landlord and tenant take on the roles of Lessor and lessee, respectively. The lessee always pays rent to the Lessor, the legal owner of the asset in a lease. The owner leases personal property to an end user in a consumer lease. Now picture a laptop. You can only use one of your computers, even if you have two. However, your pal does not currently own a computer and would benefit significantly from acquiring one. If they are willing to pay $20 per month, you can lease them the laptop.

If you own the thing and lend it to a friend, your buddy would be the lessee. The finance lease is a subset of the broader leasing industry. When it comes to spreading the risk of a product among investors and institutions, these increasingly complicated financial instruments are the norm. The Lessor owns the financial asset, such as shares, who then leases it to the lessee. Lessee may pay the owner a rental amount equal to the stock's appreciation in value.

New Lease Accounting Standards, Changes, And Complete Examples

The FASB initially collaborated with the International Accounting Standards Board (IASB) to create its new standards. The GASB's standards are distinct from those of the FASB in several ways. The new regulations will affect all businesses that engage in asset leasing. Every accounting principle has its own set of rules for deciding which kinds of deals need to be capitalised (i.e., short-term leases). However, businesses with a lease that covers at least one in-scope asset will have to adopt the new rule. A significant shift in lease accounting is the need for lease assets and liabilities to be recorded in the balance sheet for most lease arrangements. To construct a lease liability and the accompanying ROU asset, lessees need to determine the present value of the lease payments that are still to come.

Conclusion:

In a lease arrangement, one party, the Lessor, rents out some of their property to the lessee. The lease agreement is a legally binding contract between the Lessor and lessee setting down the parameters of their leasing arrangement. Although any property can be rented, homes and commercial spaces are the most prevalent examples. Depending on who owns the property, the Lessor could be a corporation or an individual. Lessors are also sometimes referred to as landlords, depending on the context.